Welcome to the K-shaped economy, defined by abifurcation in economic sentiment and outcomes. The letter “K” captures thedivergence: the upward-sloping arm represents higher-income households,supported by rising income and wealth, while the downward-sloping arm reflectslow- and middle-income households facing stagnant wages, rising living costsand heavy debt burdens. In this two-speed economy, consumer segments and thebusinesses (or business lines) serving them are growing at different rates.

In the U.S., where consumer spending makes up overtwo-thirds of GDP, this bifurcation has implications. Higher-income householdsnow drive much of the activity: in Q2 2025, the top 10 percent accounted fornearly half of all consumer spending. Economic resilience has grown moreconcentrated among the wealthy, who have benefited most from asset price gains.As a result, softer labour-market data in 2025 drew less concern, as theweakness was felt mainly by lower-income households, who had a limited impact onaggregate consumption.

Canada’s picture is more nuanced. Householdspending remained resilient in 2025 but was challenged by heightened tradeuncertainty, slower population growth and a cooling labour market. While U.S.tariffs have weighed on exports and jobs in affected industries, substantialnew spending announced in the Federal Budget is expected to offset some ofthese pressures.

What Lies Ahead for Economies and the Markets?

Looking to 2026, questions remain about thetrajectory of economies and markets. In 2025, artificial intelligence (AI) wasa key catalyst for market optimism. Debate persists around whether massivecapital investments will deliver meaningful productivity gains, though somesuggest expectations are already partly reflected in equity valuations. Ifconsumer spending endures and investments begin to show real returns, marketsare likely to continue discounting labour-market weakness, looking past thelower arm of the K.

At the same time, monetary stimulus from interestrate cuts in both Canada and the U.S., combined with tariff renegotiations andpotential U.S. tax refunds, could help stabilize labour markets and supportmore exposed sectors. However, some argue that this same stimulus has furtherwidened wealth inequality.

As equity markets reached new highs in 2025, manyinvestors have asked: Are stockprices running ahead of fundamentals, or is there still room to grow?

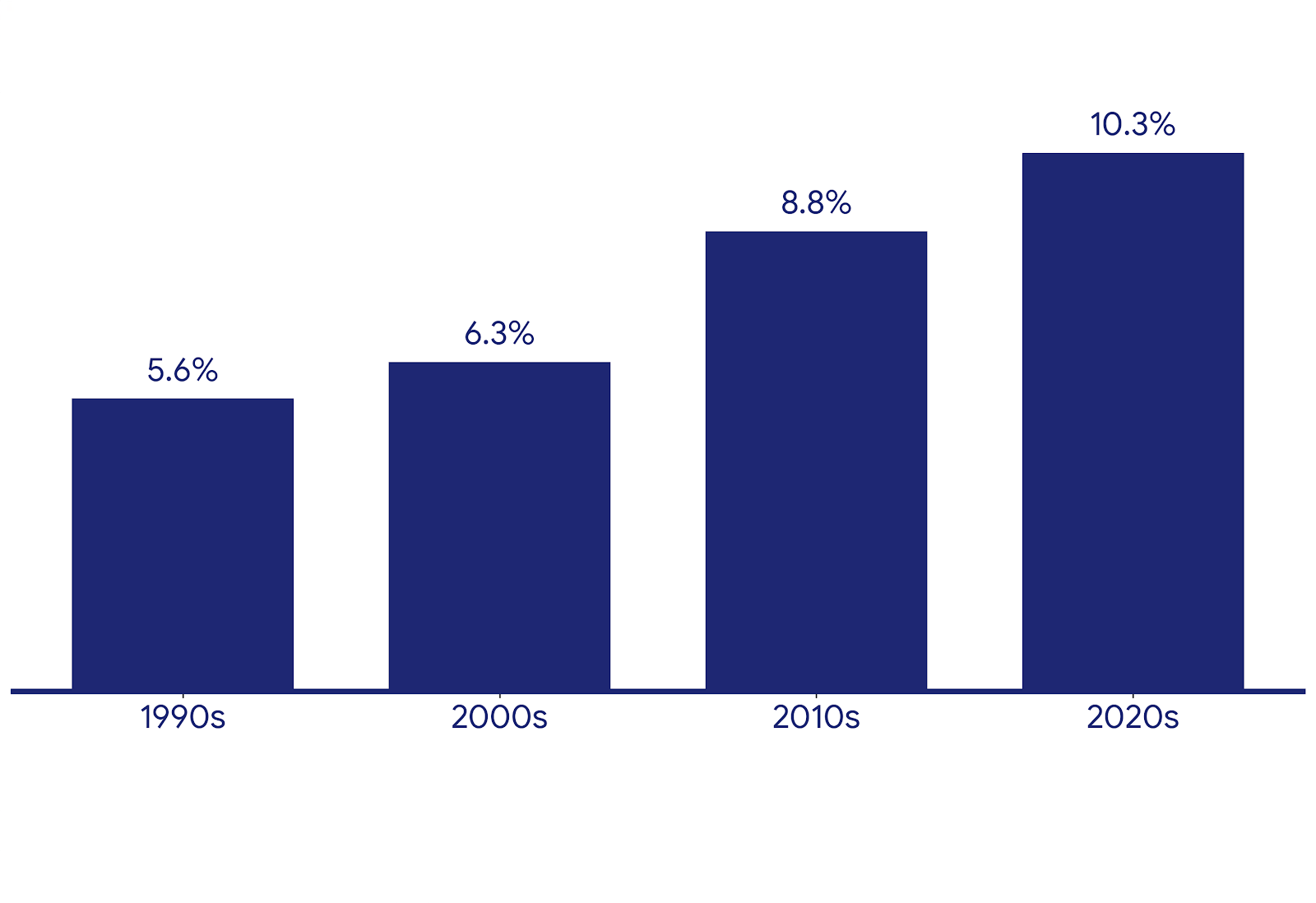

Market performance is influenced by manyforces—government policies, geopolitical events, economic growth, inflation,interest rates and even the headlines. But over the long run, corporateearnings remain a significant driver. Here, the story has been strong. U.S.corporate margins have risen, with the average S&P 500 net income marginnow above 10 percent this decade, roughly double that of the 1990s. Canada hasfollowed a similar trajectory, though aggregate corporate profits have beenmore sensitive to commodity prices.

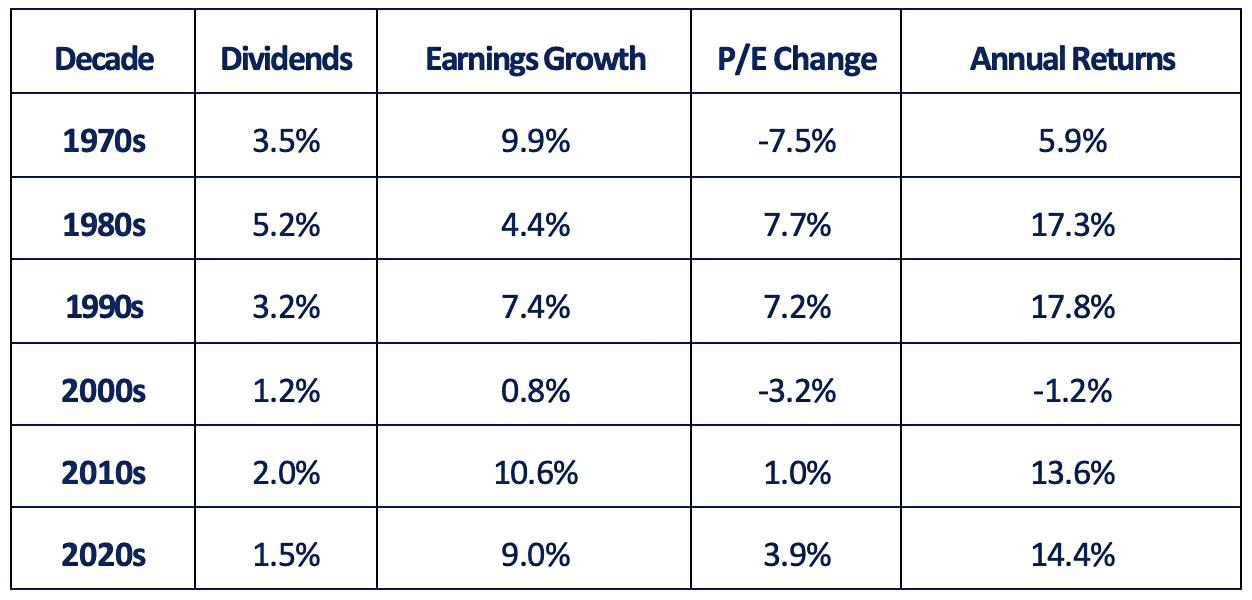

Several tailwinds suggest that growth can continue:technological innovation, productivity improvements and resilient consumerdemand all support sustained profitability. Still, history offers caution. Inthe 1970s, despite a decade of solid earnings growth (9.9%, chart),persistently high inflation and global energy shocks kept equity marketssubdued. Even so, today’s strength in earnings remains a key foundation ofmarket performance that shouldn’t be overlooked.

As advisors, we continue to navigate the evolving landscape. The K-shaped economy reinforces the value of time-tested principles, diversification, a focus on quality and disciplined risk management, as key to successful long-term wealth management in an increasingly uneven economic environment. If you have any questions, please don’t hesitate to reach out to our team.

S&P 500: Key Drivers of Stock MarketPerformance

Legendary investor John Bogle once suggested the key drivers of equityreturns are dividend yield, earnings growth and speculative return or changesin valuations (the price/earnings (P/E) change). Source: “Don’t Count on It,”J. Bogle; https://awealthofcommonsense.com/2025/10/animal-spirits-why-retail-is-outperforming/

S&P 500 Average Net Income Margin By Decade

Source: https://awealthofcommonsense.com/2025/09/why-is-the-stock-market-up-so-much-in-the-2020s/

.png)